Kim Eng on Global Voice

GV will possess a comprehensive fiber optic network

Global Voice Group (GV) has announced that it is buying a long-haul

intercity fibre network across Europe from Viatel, in order to interconnect

its existing metropolitan networks. This will give GV one of the largest

and most technically advanced fiber optic Metropolitan and Inter-city

networks in Europe. The acquisition will enable GV to generate

additional revenues arising from the additional business products and

reduced costs through the operational synergies from the combined

networks.

Long-haul interconnectivity further enhances GV’s growth

This additional long haul network capacity enhances the total value

proposition that GV can offer to clients. This applies across all of GV’s

existing business solutions i.e. Network Services, Business Continuity

Services and infrastructure. The enhanced network also fits in very well

and will accelerate GV’s expected revenue growth from bandwidthhogging

services such as broadband adoption, corporate VoIP, WIMAX,

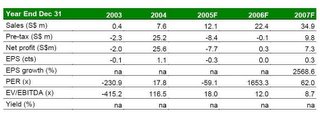

3G applications and remote realtime data backup. Pro-forma forecast

indicates a 38% upward adjustment to our FY2007 net profit forecast

based solely on this deal.

Asset backing further enhanced, and supports share price

Similar to GV’s own network, Viatel’s long-haul network was acquired at

fire sale prices following the dotcom bust. As a result, GV was similarly

able to secure attractive pricing on this asset as well. Using comparable

peers as a benchmark, we estimate GV’s new NAV could potentially be

worth Euro 577m, or $0.479 per share, on the back of this deal. This

compares to our metropolitan network’s standalone valuation of S$0.365

per share.

Fair value S$0.27/share; Buy recommended

We are not changing our forecasts and price target of S$0.27 at the present

moment, as the deal will be completed only at end-March. We had previously

valued GV’s share price at S$0.27 from an operational viewpoint, with

valuation of about Euro 350m using a sum-of-parts approach. However, we

believe there is a strong potential for this target to be raised as we, and the

market, digest the full advantages of this acquisition. We maintain our Buy

recommendation with target price of S$0.27.

0 Comments:

Post a Comment

<< Home