Hongbao rally for market ahead of Chinese New Year

Business Times

By VEN SREENIVASAN

SENIOR CORRESPONDENT

A POSITIVE overnight close on Wall Street followed by strong sessions in other key Asian bourses - especially Tokyo - sent the Singapore market to one of its highest ever levels ahead of the Chinese New Year long weekend. 'It's a hongbao rally,' quipped a broker here.

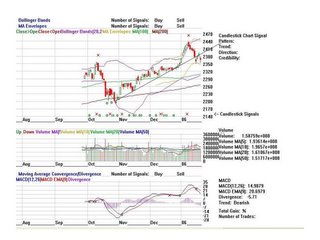

Indeed, there was a palpable surge in the market undertone after the recent jitters on Tokyo and Wall Street. The Straits Times index gained 23.06 points to 2412.08, boosted by the likes of Singapore Airlines (SIA), DBS Group, Jardine Matheson and Fraser & Neave (F&N).

Overall market volume was strong, with some 1.5 billion units worth some $1.4 billion changing hands as rises led falls by almost four to one.

The strong uptick comes at the heels of the Dow Jones' 100 points overnight gain to 10,809. The Nasdaq Composite climbed more than 22 points to 2,283 on Thursday, while the Standard & Poor's 500 Index gained 9.6 points to 1,274 points.

It also helped that in Tokyo, the Nikkei seems to be recovering nicely from the Livedoor scare, and posted a 569.66 points gain to 16,460.68 points on the back of banking and consumer stocks.

And though blue chips lead the benchmark index higher yesterday, the gains were broadly based and supported by a noticeably upbeat market undertone.

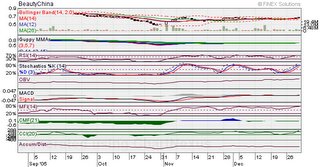

Technology and China plays were among the day's volume leaders. The heavyweight risers were led by SIA, whose stock gained 40 cents to a new high at $14.20. Several brokerages have recently upgraded SIA in recent weeks, citing its strong market position, buoyant industry conditions and the potential cash from the sale of subsidiaries. DBS Bank was up 20 cents to $16.40, while F&N gained 70 cents to a new high at $18.80.

Chartered Semiconductor Manufacturing, which posted a higher-than-expected 4Q05 net income of US$26.5 million on the back of US$367.2 million turnover, was the most actively traded counter. The stock was up six cents to $1.40 on some 74 million shares as analysts upgraded the company's full year earnings forecast.

Meanwhile, Utac, which surprised with 4Q05 net profit of US$20 million, was up 3.5 cents to 92.5 cents. Heart stent-maker Bionsensors hit a high at $1.09 before pulling back to close with a net two cent decline for the session at $1.05, amid speculation that it was a potential takeover target for global giant Johnson & Johnson, which lost its bid to buy Guidant Corporation to rival Boston Scientific.

One sector which seems to be particularly favoured, but did not feature much in the day's bullish session, was the anchor handling and tugs supply sector (AHTS).

In a report issued this week, BNP Paribas says the sector was a late beneficiary of the upturn in the offshore oil and gas industry. 'Lagging South-east Asian AHTS rates are now just starting to track North Sea rates up and Singapore-listed AHTS players look cheap on a global basis,' it notes. 'Our top picks are Ezra and Labroy, both offering 65 per cent upside.'

But the stock of shipbuilder and marine equipment repairer ASL Marine rose 5.5 cents to 70.5 cents after it reported a doubling of interim earnings to $12.3 million.

Market insiders see generally bullish undertones continuing to support the Singapore market during the next few months - barring unforeseen shocks of course.